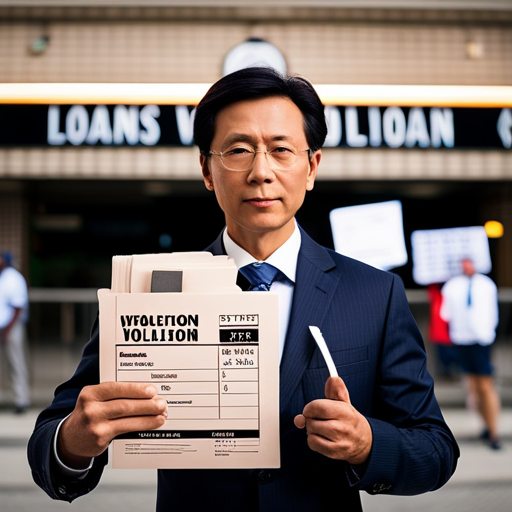

Traffic violation fines can often catch us off guard and create financial strain. However, there is a solution that can help ease the burden of these unexpected expenses – obtaining a personal loan. A personal loan offers various benefits when it comes to handling traffic violation fines, providing individuals with an effective way to manage their financial obligations.

One of the key advantages of using a personal loan for traffic violation fines is its flexibility. Unlike other forms of financing, personal loans do not have specific restrictions on how the funds can be used. This means that individuals have the freedom to allocate the loan amount towards paying off their traffic violation fines without any limitations.

Additionally, securing a personal loan for traffic violation fines can also offer favorable terms and conditions. By comparing different lenders and negotiating interest rates, borrowers have the opportunity to find competitive rates that suit their needs and budget.

In conclusion, utilizing a personal loan to handle traffic violation fines presents an advantageous option for individuals seeking financial assistance. With its flexibility and potential for favorable terms, it allows individuals to effectively manage their financial obligations while maintaining control over their finances.

Key Takeaways

- Personal loans offer flexibility in how funds can be used.

- Borrowers can compare lenders and negotiate interest rates for favorable terms.

- Promptly settling traffic violation fines can avoid increased penalties or license suspension.

– Using savings or credit cards to pay fines can negatively impact financial stability or credit score.

The Benefits of Using a Personal Loan for Traffic Violation Fines

One advantage of utilizing a personal loan to pay for traffic violation fines is that it provides the opportunity to promptly settle the financial obligation, ensuring peace of mind and avoiding potential repercussions such as increased penalties or license suspension.

Alternatives to personal loans for paying traffic violation fines may include using savings or credit cards, but these options could have negative consequences on one’s financial stability or credit score.

To secure the best loan terms, individuals should consider following certain tips and strategies.

Tips for Securing the Best Loan Terms

To ensure favorable loan terms, it is crucial to carefully evaluate and compare different lending institutions. When comparing loans for handling traffic violation fines, consider the following:

- Interest rates: Look for lenders offering competitive interest rates to minimize the overall cost of borrowing.

- Loan terms: Choose a loan with flexible repayment options that suit your financial situation.

- Fees and charges: Compare any additional fees or charges associated with the loan.

- Credit score impact: Understand how taking out a personal loan may affect your credit score.

By conducting thorough research and comparison, individuals can secure the best loan terms for their needs while minimizing any negative impact on their credit score.

Conclusion

In conclusion, using a personal loan to handle traffic violation fines offers several benefits. It allows individuals to pay off their fines immediately and avoid any potential consequences such as license suspensions or increased penalties.

Additionally, securing the best loan terms can help individuals save money on interest rates and fees.

By taking action and considering a personal loan, individuals can effectively manage their traffic violation fines in a timely manner and alleviate the financial burden associated with them.